第一百零九期财务与会计学术论坛

时间:2016年09月28日 来源: 浏览:次

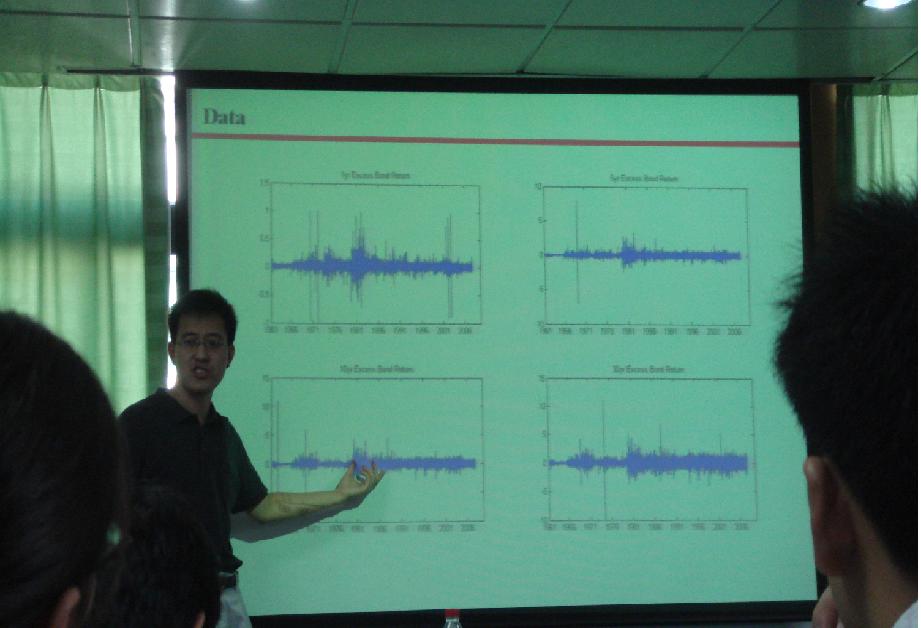

题目: Macro Factors and Volatility of Treasury Bond Returns

演讲者:LEI LU,Assistant Professor of Finance, Shanghai University of Finance & Economics

时间: 2009年10月9日(星期五)3:00—4:30PM

地点: 嘉庚二501

参加者: 对财务研究有兴趣的广大师生

主持人: 沈哲老师

论文摘要:

This paper investigates the impact of macroeconomic variables on the volatility of Treasury bond returns. By using principal components analysis, we extract the “real” and “monetary” macro factors from the real activies and monetary variables, respectively. We find that these macro factors have a significant impact on the volatility of Treasury bond returns. In particular, we find that the real activities affect the return volatility across all maturities, while the monetary variables are significantly related to the volatility of short- and medium-term bonds only. The implication of these findings is that the policy makers can employ monetary policy to stabilize the fluctuation of short- and medium-term bonds, but need to take the real activities into account when stabilizing the fluctuation of long-term bonds.

论文作者简介:

Dr. Lu Lei is assistant professor of finance at Shanghai University of Finance & Economics. Dr. Lu got bachelor and master degree in management from Zhengzhou University and Tianjin University respectively. He got PhD in Finance from McGill University. His research interests include asset pricing (theoretical and empirical), macro finance, fixed income and Chinese financial markets.

下载:论文.pdf