57th Seminar on Finance and Accounting

November 8, 2016

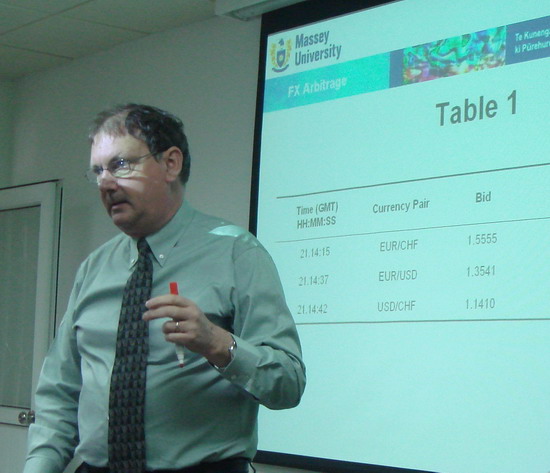

Topic: Exploitable Arbitrage Opportunities Exist in the Foreign Exchange Market

Presenter:Martin Young, Associate Professor,Head, Department of Finance, Banking and Property,

Time: November 27, 2007(Tuesday)9:00—10:30 AM

Venue: Room 513, Jiageng Bld 2

Chair: Yujun Wu, assistant professor in finance, IFAS

Abstract:

We provide some of the first empirical evidence of the compensation required by arbitrageurs to collect information on which to trade. The Grossman and Stiglitz (1976, 1980) propositions regarding this have previously gone untested due to the inability to control for pervasive impediments to arbitrage. Using binding quotes from the highly liquid spot foreign exchange market we find mean triangular arbitrage opportunities ranging from 2.0 to 3.8 basis points across seven major currency pairs. Well documented impediments to arbitrage do not explain the profits on offer so we conclude they are in fact compensation to arbitrageurs for providing liquidity.

Presenter Introduction:

Dr Martin Young is an Associate Professor of Finance in and Head of the Department of Finance, Banking and Property,

Download: paper